Firstly I want to begin with the yesterday hack of bitcoin-central.net, and as you can see in their update "A few hundred Bitcoins have been stolen" from their "hot wallet". Nevertheless bitcoin-central.net announced "We will cover 100% of the theft."

|

| bitcoin-central.net hacked update |

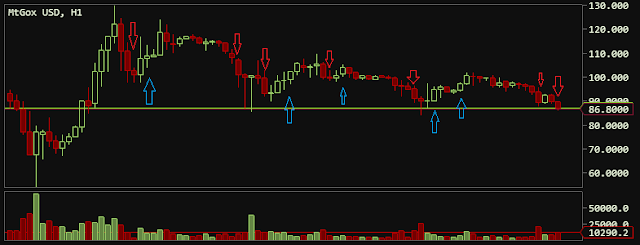

The question is, did this had anything to do with the panic sell of BTC/USD at around $148 till $120? Did the hackers DDoSed both MtGox and BTC-e and other exchanges to cause panic to the traders and cause this hysteric sell-off?

As you can see in the following picture, bots are trading back and forth in order to cause lag and panic. The amount of BTC in the screenshot starts from 0.0072 till it reaches 0.0059 due to fees. I saw this happening in front of my eyes and this continued until this trade reached 0 BTC. The lag was enormous and reached 2 minutes and 55 seconds, but unfortunately i don't have any screenshot of this.

|

| Reddit Post About This Trade |

Furthermore from btc-e.com we had a weird behavior of the most well known chat in the history of bitcoin, the "trollbox", were thousands of traders meet to exchange knowledge on the theme of bitcoin, mostly causing panic in one another and usually loosing money from time after time. A small exception to this is that "trollbox" includes well known sophisticated traders that try in vain to calm people down.

"Trollbox" got stuck and didn't autorefresh causing even more panic, trolling, hysteria and laugh.

|

| trollboxarchive.com about stuck trollbox |

To conclude with this blogpost, from my part I can say that I was expecting a normal correction of the price but unfortunately we had this panic selling due to the events above. Panic selling is bad for any market, but it seems BTC is recovering very quickly. You can read a good article from thegenesisblock.com analyzing: H&S Pattern Dissolves, Expected Retest and Drop Realized

~Source~

trollboxarchive.com

bitcoin-archive.com

thegenesisblock.com

bitcoin.clarkmoody.com

reddit.com